Welcome to my DCA Series, Round 2.

In this article I will take you through the process that I follow to determine which cryptocurrencies to buy whenever I dollar cost average.

I thought it would be fun and interesting to create a DCA portfolio, and track its performance over the next few years.

The portfolio concentrates on the top 100 cryptocurrencies, but can include a few smaller cap coins that I’m especially interested in.

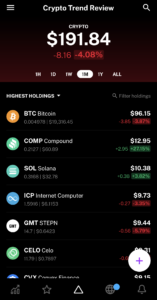

Below is the the portfolio performance since I started it on 09-01-2022: -4.08%.

Once the portfolio is older than 30 days, I’ll start posting performance comparisons to total crypto market, Bitcoin, and Ethereum.

If you want to stay up to date on it, follow me on Twitter and Instagram.

DCA SIGNAL TRIGGERED ON 09-26-2022

My conditions to DCA were met on 09-01-2022. These include:

- After the total crypto market cap’s 2-day RSI dips below 10, it closes above its 7-day moving average and is up on a 7-day basis.

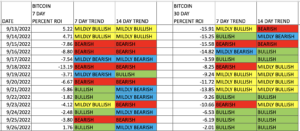

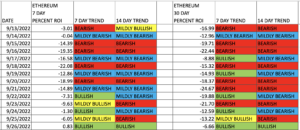

- The 7-day and 30-day Percent ROI of Bitcoin and Ethereum flip bullish.

50% ALLOCATION TO BITCOIN OR ETHEREUM

I allocate 50% of my DCA funding to Bitcoin or Ethereum. Since I’m a long term value investor, I choose the under performer based on the 30-day percent ROI.

Bitcoin 30-day percent ROI = -2.01%

Ethereum 30-day percent ROI = -6.66%

Ethereum is the under performer in this DCA round.

50% ALLOCATION TO OTHER TOP 100 PROJECTS UNDERPERFORMING ETHEREUM

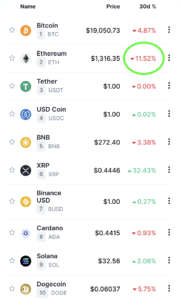

We can use Coin Market Cap to find potential DCA opportunities by identifying projects currently underperforming Ethereum on a 30-day ROI basis.

For example, Ethereum’s 30 day ROI is -11.52% according to Coin Market Cap, so any cryptocurrency that has a 30 day ROI less than -11.52% is worth looking at.

Below is the initial short list. I excluded stable coins, Bitcoin forks, test networks, and projects that I have little hopes for.

Shiba Inu -11.56%

Avalanche -14.44%

UNUS SED LEO -21.80%

Decentraland -11.99%

The Sandbox -13.63%

EOS -24.07%

Axie Infinity -11.59%

Helium -24.34%

Fantom -18.66%

THORChain -20.59%

Curve DAO Token -12.18%

Basic Attention Token -13.64%

Stacks -11.70%

Zilliqa -15.37%

Mina -11.87%

Loopring -18.14%

Kava -13.56%

Gnosis -19.21%

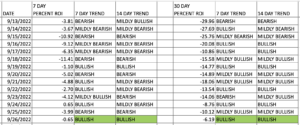

I like to get this list down to 10 or less, so I eliminate projects that have a worse ROI trend score than Bitcoin.

For example, Ethereum’s 7-day best trend score is BULLISH, and it’s 30-day best trend score is BULLISH, so any project with best trend scores of MILDLY BULLISH or worse were excluded.

Decentraland has a best trend score of BULLISH on both a 7-day and 30-day basis, so it made the revised short list.

Below is the list of projects that made the revised short list.

Please note, Mina Protocol and Gnosis made the short list, but since I could not buy them on Binance nor Kucoin, I had to exclude them.

Decentraland

Fantom

THORChain

Basic Attention Token

Stacks

Zilliqa

Loopring

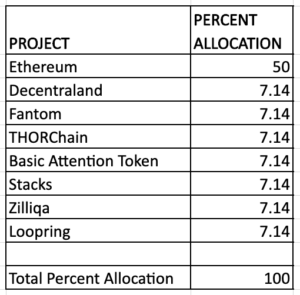

DCA ROUND 2 PORTFOLIO

Below is the final allocation of my DCA funds for this round.